Written by

Jirayr Kembikian, CFP®

History has shown us that innovations like the automobile and internet have transformed society in unimaginable ways. Because they were disruptive technologies, they had to go through a transitional phase where they were heavily criticized. Much like other disruptive technologies, Bitcoin has also been heavily criticized and largely misunderstood. Similarly, Bitcoin is positioned to challenge the legacy finance system and reshape our understanding of money.

Technological adoptions over time

Bitcoin has been met with skepticism and criticism since its inception. Many of these critiques are due to its energy usage, however it’s important to acknowledge that innovation often brings initial inefficiencies and a large environmental footprint. As technologies evolve, they become more efficient and environmentally friendly. This was even the case for solar power and electric vehicles.

It’s also crucial to recognize that energy usage is not the key driver of environmental damage – it’s our emissions. Environmental thought leader Saul Griffith advocates in his book, Electrify, that energy usage is pivotal for the advancement of a sustainable, renewable energy grid. By using primarily sustainable and affordable electricity, Bitcoin mining is already playing a part in promoting an eco-friendly energy consumption system.

Just like any disruptive technology, Bitcoin has been evolving and maturing, unveiling a variety of environmental, social, and governance (ESG) benefits. Bitcoin is making a positive impact in these areas while dispelling common misconceptions. As a result, the potential for a brighter and more sustainable future is becoming evident thanks to Bitcoin.

ESG refers to the three key factors—environmental, social, and governance—that measure the sustainability and societal impact of an investment strategy. In recent decades, ESG strategies have gained considerable traction. Individuals and institutions alike are increasingly recognizing the vital role they play in creating a more ethical, inclusive, and responsible global economy.

But why do people care about ESG principles, and why should you care about Bitcoin’s impact in these areas? By embracing ESG principles and harnessing the power of Bitcoin, we can foster a greener planet and promote social inclusivity. Below are the ESG characteristics of Bitcoin and why it holds immense promise for a sustainable future.

Environmental Benefits:

Ironically, the data now proves Bitcoin can actually positively impact our environment in several ways, contrary to the overwhelming initial narratives.

1. Utilizing stranded energy and mitigating emissions:

There are many ways Bitcoin mining can reduce global emissions. Bitcoin mining can harness wasted energy from a variety of different energy sources that are often in remote locations and otherwise expensive to deploy. Drilling for oil produces methane gas. Methane traps more heat in our atmosphere than CO2 and is 80 times more harmful. The United Nations reported that “cutting methane is the strongest lever we have to slow climate change over the next 25 years.” More Bitcoin mining operations are now consuming methane, which will significantly aid in our climate change initiatives.

It turns out that Bitcoin mining is emerging as the best investment for reducing emissions. According to ESG analyst Daniel Batten, methane from landfills should be the primary focus to improve climate change. Bitcoin mining projects that monetize vented methane from landfills can be the world’s most effective environmental investment per dollar spent.

Assumptions: $1M/MW solar instal cost. 450g/kWh gridmix $25/TH ASICS. Generators USD900K/MW. 90% uptime

However, it’s not just capturing wasted gas, Bitcoin miners are also now utilizing wasted energy from renewable sources like hydro, wind, and solar projects too. As a result, this will further increase sustainability and bring forth more renewable energy projects.

Powering the Bitcoin network produces far lower emissions than the other industries such as the banking, industrial, agricultural sectors, and gold and steel/iron industries. It is on track to become the first major industry to go emission negative without the use of any offsets. As a result, adding Bitcoin to an investment portfolio can have a positive impact on the overall portfolio carbon footprint, and is less energy intensive than many traditional equity investments.

2. Energy consumption:

Before we dive into Bitcoin’s energy consumption data, it’s important to understand why the Bitcoin network uses energy. As anyone can join the Bitcoin network and start mining, it’s important to have a security feature and a means to safeguard the network, Bitcoin’s validity, and transaction history. Energy is spent in the form of electricity, which powers the computers of Bitcoin miners. The energy cost makes it prohibitively expensive to commit any form of fraud or to hijack the network. While the common misconception is this is wasting energy, the reality is it’s reinforcing the most secure computer network in the world (more on that later).

Bitcoin’s energy consumption has often been overstated, and the evidence now proves this. The Bitcoin network currently uses much less than 1% of global energy. If and when Bitcoin becomes widely adopted, its global energy consumption could reach around 1%, not the 100% that has been claimed.

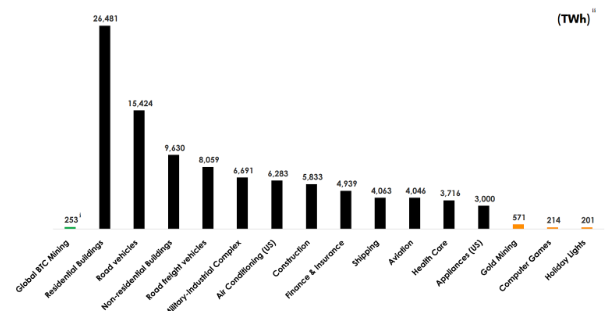

Annual energy consumption of Bitcoin mining versus other industries

In addition, Bitcoin has significantly lower energy consumption than our current financial system, which should be the main comparison. Bitcoin consumes over 50 times less energy annually than the combined energy usage of data centers, branches, ATMs, and credit card networks.

3. Renewable energy adoption:

Bitcoin’s renewable energy usage is higher than any other industry sector, and higher than any other large industrialized country.

Bitcoin networks renewable energy usage in comparison to other countries

Over 50% of Bitcoin’s energy consumption now comes from renewable and clean sources, and this percentage continues to increase every year. This is because Bitcoin miners are highly incentivized to use the least expensive energy sources to remain profitable. Today, solar and wind are the cheapest sources of electricity in history. As Bitcoin miners continue to utilize renewable and even stranded energy sources, Bitcoin’s carbon footprint will be further reduced.

4. Conservation and green energy initiatives:

Bitcoin’s potential extends beyond traditional financial applications. It can be applied to conservation and green energy initiatives too. In Virunga National Park, Africa’s oldest protected park located in Congo, Bitcoin mining has become a means to safeguard their wildlife and forest from poachers and local militias. The park is now sustained by Bitcoin mining operations, which runs on clean hydropower energy, and supports its environmental preservation.

Similarly, in Texas, Bitcoin is being leveraged to balance and green energy grids through dynamic load response. This approach plays a vital role in promoting renewable energy sources and proves to be profitable too. By utilizing Bitcoin mining as a tool to incentivize and optimize energy consumption, Texas-based Bitcoin miners have taken significant steps toward a greener and more sustainable energy landscape.

These examples highlight the versatility and potential of Bitcoin beyond its financial applications. By integrating Bitcoin mining with conservation and renewable energy efforts, the positive impacts are clear.

Social Benefits:

Bitcoin offers numerous social benefits by promoting financial inclusion and empowering individuals worldwide.

1. Financial inclusion:

There are approximately 1.4 billion individuals across the globe who are excluded from the traditional financial system. This group is the unfortunate result of the stringent regulations attempting to fight terrorism and money laundering. Furthermore, there continue to be countless cases of financial discrimination by the legacy banking system. This paradigm continues to widen the global wealth gap and further reinforces the subjugation of those without financial means. By circumnavigating banks’ discriminatory practices, Bitcoin provides an avenue for individuals to access capital, start and conduct businesses, and ultimately advance their lives. Unlike the current global banking system, Bitcoin is indiscriminate.

Technologies are emerging that further enhance the usability of Bitcoin, allowing for further financial inclusion. One of these is the Lightning network, which is built on top of the Bitcoin blockchain and offers significant benefits. It improves Bitcoin’s scalability, reduces transaction costs, and accelerates settlement times, allowing more people to access the Bitcoin network.

With increased scalability, Bitcoin becomes more accessible to people with limited financial resources or in regions with underdeveloped financial infrastructure. It can promote financial inclusion, enable more people to participate in the global economy, and potentially lift them out of poverty. Additionally, the Lightning network may empower individuals and businesses by facilitating faster and lower cost microtransactions. This can support the growth of many businesses that rely on small, instantaneous payments, further stimulating entrepreneurship and innovation for individuals and communities. These advancements contribute to a more inclusive and economically vibrant future for Bitcoin.

2. Supports freedom and anti-oppression:

Over 50% of the global population lives under authoritarian or semi-authoritarian regimes. Bitcoin serves as a lifeline for individuals living under these terrible circumstances. Below are some use cases where Bitcoin has provided a positive framework for people’s lives.

-

Governments are increasingly controlling and limiting access to people’s funds. Countries such as Iran, Nigeria, and Lebanon have recently instituted daily withdrawal limits. It becomes nearly impossible to conduct business or prosper under these situations. Bitcoin enables anyone to access and maintain their assets without government control.

-

Bitcoin has emerged as a powerful force in Africa, offering liberation to over 180 million individuals currently bound to the CFA franc, which has long exploited Africa’s wealth and resources, and has been deemed significantly disruptive to the region’s economic development. With heavy restrictions, excessive capital collateral requirements, and perceived imperialistic influence, the CFA franc system has faced growing discontent among its members. Consequently, it comes as no surprise that Bitcoin has experienced substantial adoption in Africa, offering an alternative path to financial empowerment and economic sovereignty.

-

Bitcoin has been instrumental in facilitating fundraising for social causes and activism. For instance, it has helped Nigerian gender equality protestors and freedom protestors in Belarus and Canada by providing a permissionless means of transferring funds, unaffected by government policing.

-

Women in Afghanistan are using Bitcoin to earn and save money for their families so the Taliban can’t seize or limit their money access. This is crucial because the legacy banking system does not serve them.

-

Groups such as “Women in Distress” are promoting Bitcoin as a tool for escaping and surviving domestic violence.

3. Affordable energy access:

Nearly one billion people live without access to electricity, particularly in Africa. In regions lacking electrical infrastructure, companies like Gridless are leveraging existing power sources to bring affordable energy to rural areas via Bitcoin mining. As a result, Bitcoin mining is facilitating the socio-economic advancement of these areas.

4. Cross-border transactions:

Around 800 million people in the world rely on their families and friends to send them money so they can live. Traditional institutions charge, on average, 7 percent of the total amount being sent in transfer fees. In addition, for numerous countries, especially in Africa, the ability to remit money remains restricted or limited. Bitcoin enables seamless and cost-effective cross-border transactions. Bitcoin is now even accessible via non-smartphones with no internet connectivity.

Governance Benefits:

Bitcoin’s governance model promotes fairness and distinguishes itself from the traditional financial system.

1. Decentralization and permissionless nature:

Bitcoin operates on a decentralized network, which sets it apart from traditional financial systems. Unlike centralized systems, such as banks or governments, Bitcoin operates without a central authority controlling transactions. Instead, a distributed network of computers, which anyone can join, collectively maintain the integrity and security of the Bitcoin blockchain.

Decentralization in Bitcoin is achieved through a consensus mechanism. This approach ensures that no one has control over the network or can manipulate transactions. Since its inception, Bitcoin has become the most secure and reliable digital system in the world. The Bitcoin blockchain has never been hacked or had a counterfeit produced.

By removing the need for intermediaries and central authorities, Bitcoin offers increased transparency, security, and censorship resistance. It unshackles users so they can own their money without any seizure risk, conduct peer-to-peer transactions, and participate in the validation process. Decentralization is a core principle of Bitcoin, aligning with the ideals of financial sovereignty and democratized access to wealth and opportunities.

2. Transparent and ethical protocol:

Bitcoin’s monetary policy is set by mathematical principles, not unelected bureaucrats. The underlying Bitcoin ledger ensures full transparency for transactions, immutability, privacy, and security. All transactions are publicly recorded and consistently verified. This further enhances accountability and reduces the potential for fraud or corruption.

3. Protection against long-term currency devaluation:

Over 470 million people around the world are living under hyperinflation. With widespread global currency devaluations and inflation caused by central banks, Bitcoin provides a safe haven for individuals seeking to preserve their wealth. The US dollar is the global reserve currency and is still widely considered the strongest fiat currency, yet it still has lost over 98% of its value since 1971. As Bitcoin is not controlled by a bank or government, no one can manipulate it, corrupt it, or print more of it. Unlike traditional fiat currencies, Bitcoin’s finite supply safeguards against value erosion over the long-term.

Conclusion:

Despite its initial critics, Bitcoin is continuing to establish itself as a transformative force with significant environmental, social, and governance benefits. It leverages wasted energy, promotes financial inclusion, empowers individuals in repressive regimes, and upholds transparent governance. As Bitcoin continues to evolve and technology advances, it holds immense potential to reshape our world with a positive vision. Embracing this disruptive technology with an open mind can unlock a brighter future for humanity.

Jirayr started his career with one of the nation’s largest banks, where he repeatedly witnessed the enduring impact of a solid financial plan on clients’ success. This led him to pursue a career as a financial planner with a mission to provide all clients with a financial roadmap and professional guidance in order to help them reach their full potential.

Today, Jirayr is a managing partner and wealth advisor at Citrine Capital, where he serves as an Investment Advisor Representative (IAR) and a CERTIFIED FINANCIAL PLANNER™ professional.

Prior to joining Citrine Capital, Jirayr was a financial planner at Ameritas Investment Corporation where he helped hundreds of individuals, families, and small businesses develop a financial plan and work towards their financial goals.

Jirayr holds a degree in finance from San Francisco State University. Born and raised in Marin County, he is an active community and board member in local service organizations. He is passionate about his active lifestyle including sports, mountain biking, hiking, photography and international travel.